Apeejay Surrendra Park Hotels IPO review (Apply)

• ASPHL has created a niche place in hospitality industry with over 5 decades’ experience.

• It leads the segment with highest occupancy rates that brings more rewards.

• After suffering setback during pandemic period FY21 and FY22, it is back on track.

• Based on annualized FY24 earnings, the issue appears fully priced, but post IPO, clearance of its debts its finance cost will reduced drastically and lift the earnings.

• Considering its plans, Investors may park funds for the medium to long term rewards.

ABOUT COMPANY:

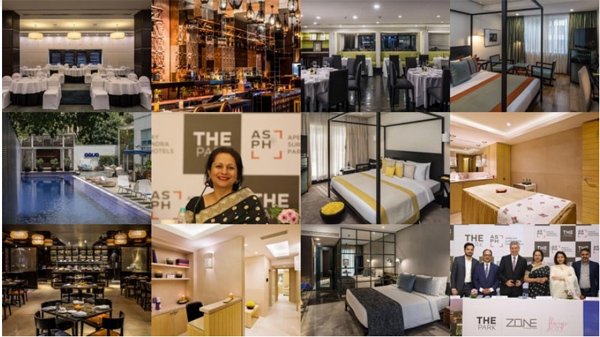

Apeejay Surrendra Park Hotels Ltd. (ASPHL) is engaged in the hospitality business operating under the brand names of “THE PARK”, “THE PARK Collection”, “Zone by The Park”, “Zone Connect by The Park” and “Stop by Zone”. The company is also engaged in the business of retail food and beverage industry through its retail brand ‘Flurys’.

Among hotel chains with asset ownership, the company ranks as the eighth largest in India in terms of chain affiliated hotel rooms inventory as of September 30, 2023 (Source: Horwath HTL Report). Of the 45,800 rooms owned by chained affiliated hotels across the country as at September 30, 2023, ASPHL comprises of about 1,300 rooms constituting 2.80% of the total inventory (Source: Horwath HTL Report).

It operates hospitality assets under own brands, “THE PARK”, “THE PARK Collection”, “Zone by The Park”, “Zone Connect by The Park” and “Stop by Zone”. The company has a long-standing expertise of over 55 years in the hospitality business of owning and operating hotels, with its first hotel being launched under our brand “THE PARK” at the iconic Park Street in Kolkata. It has established presence in the retail food and beverage industry through retail brand ‘Flurys’.

ASPHL has pioneered the concept of luxury boutique hotels in India under own brand, “THE PARK”, extending it further through and “THE PARK Collection”, and in upper-midscale categories with its brands “Zone by The Park” and “Zone Connect by The Park”. Its hotel portfolio has a PAN-India presence, and continues to attract customers with its diversified portfolio. The company categorizes its hotel portfolio into two distinct hotels categories based on brand classification upscale, and upper mid-scale. It operates hotels under following four brands, namely “THE PARK, “THE PARK Collection”, “Zone by The Park”, “Zone Connect by The Park” and have recently launched economy motel brand, “Stop by Zone”:

It operates individual hotels with distinctive character, and provide curated experiences to guests. ASPHL’s hotels are differentiated through design and art, events, and entertainment and in providing unique, memorable, and immersive service experiences. Differentiation is also part of “Zone by the Park” brand which is being specially developed for India’s tier 2 and tier 3 cities through use of modern design and local influences. Its focus is on profitability, return on capital employed and growth of the Company for the long-term benefit of stakeholders.

As of September 30, 2023, it operates 81 restaurants, night clubs and bars, offering a wide selection of culinary experiences. The night club and entertainment division contribute to its brand positioning and allows cross-selling opportunities. The company has created award-winning brands such as Zen, Someplace Else, Tantra, Roxy, iBar, The Leather Bar, Pasha and Aqua.

It also operates a premium retail chain in the food and beverage business under the brand ‘Flurys’, which possesses a successful and profitable track record of Industry leading EBITDA margins. ‘Flurys’ operates 73 outlets Pan India under multiple formats such as restaurants, cafés, and kiosks. As of the date of this Red Herring Prospectus, it operates 64 outlets in Kolkata and rest of West Bengal, eight outlets in Mumbai and Navi Mumbai, and one outlet in New Delhi. ASPHL intends to leverage on its expertise in the hospitality industry to develop and grow presence in the retail food and beverage industry and expand the outlets of Flurys across India.

As on the date of this Red Herring Prospectus, it operates 30 hotels across luxury boutique upscale, and upper midscale categories, with Pan-India presence in metros such as Kolkata, New Delhi, Chennai, Hyderabad, Bangalore, and Mumbai as well as in other major cities such as Coimbatore, Indore, Goa, Jaipur, Jodhpur, Jammu, Navi Mumbai, Visakhapatnam, Port Blair, Pathankot representing 2,298 rooms. As of September 30, 2023, it had 2030 employees on its payroll.

ISSUE DETAILS/CAPITAL HISTORY:

The company is coming out with its maiden combo book building route IPO consisting fresh equity shares issue worth Rs. 600 cr. (approx. 38709696 shares at the upper cap), and an Offer for Sale (OFS) worth Rs. 320 cr. (approx. 20645161 shares at the upper cap). Thus the overall size of the IPO is worth Rs. 920 cr. (approx. 59354857 shares at the upper cap). The issue opens for subscription on February 05, 2024, and will close on February 07, 2024. It has announced a price band of Rs. 147 – Rs. 155 for equity share of Re. 1 face value. The minimum application to be made is for 96 shares and in multiples thereon, thereafter. Post allotment, shares will be listed on BSE and NSE. The issue constitutes 27.82% of the post-IPO paid-up capital of the company. From the net proceeds of the fresh equity issue, it will utilize Rs. 550.00 cr. for repayment/prepayment of certain borrowings, and the rest for general corporate purposes.

The company has reserved shares worth Rs. 10 cr. for its eligible employees and offering them a discount equivalent to Rs. 7 per share and from the rest, it has allocated not less than 75% for QIBs, not more than 15% for HNIs and not more than 10% for Retail investors.

The joint Book Running Lead Managers (BRLMs) to this issue are JM Financial Ltd., Axis Capital Ltd., and ICICI Securities Ltd., while Link Intime India Pvt. Ltd. is the registrar of the issue.

Having issued/converted initial equity shares at par, the company issued further equity shares at a fixed price of Rs. 77.67 (based on Re. 1 FV) in July 2007. The average cost of acquisition of shares by the promoters/selling stakeholders is Rs. 0.08, Rs. 0.40, Rs. 0.60, Rs. 0.75, Rs. 77.67, and Rs. 109.81 per share.

Post-IPO, company’s current paid-up equity capital of Rs. 17.47 cr. will stand enhanced to Rs. 21.34 cr. Based on the upper cap of IPO price band, the company is looking for a market cap of Rs. 3307.26 cr.

FINANCIAL PERFORMANCE:

On the financial performance front, for the last three fiscals, it has posted a total income/net profit/ – (loss) of Rs. 190.29cr. / Rs. – (75.88) cr. (FY21), Rs. 267.83 cr. / Rs. – (28.20) cr. (FY22), and Rs. 524.43 cr. / Rs. 48.06 cr. (FY23). It suffered for FY21 and FY22 as per general trends for the hospitality sector on account of the Pandemic. For H1 of FY24 ended on September 30, 2023, it earned a net profit of Rs. 22.95 cr. on a total income of Rs. 272.31 cr. It followed the improved trends from FY23 onwards and is poised for bright prospects ahead with its infra in place and expansion plans up the sleeve.

For the last three fiscals, it has reported an average EPS of Rs. 0.12 and an average RoNW of 0.51%. The issue is priced at a P/BV of 4.68 based on its NAV of Rs. 33.13 as of September 30, 2023, and at a P/BV of 2.86 based on its post-IPO NAV of Rs. 54.15 per share (at the upper cap).

If we attribute annualized FY24 earnings to its post-IPO fully diluted paid-up equity capital, then the asking price is at a P/E of 72.09. Though it appears fully priced on the basis of annualized FY24 numbers, it is poised for bright prospects ahead and declined finance cost will boost its net earnings going forward.

For the reported periods, the company has posted PAT margins of – (39.88) % (FY21), – (10.53) % (FY22), 9.16% (FY23), 8.43% (H1-FY24).

DIVIDEND POLICY:

The company has not declared any dividends for the reported periods of the offer document. It has adopted a dividend policy in December 2019 based on its financial performance and future prospects.

COMPARISON WITH LISTED PEERS:

As per offer document, the company has shown Chalet Hotels, Lemon Tree, Indian Hotels, EIH Ltd., and Samhi Hotels as their listed peers. They are trading at a P/E of 66, 85.20, 63.70, and 44.80 (as of January 31, 2024). However, they are not comparable on an apple-to-apple basis.

MERCHANT BANKER’S TRACK RECORD:

The three BRLMs associated with the offer have handled 94 public issues in the past three fiscals, out of which 24 issues closed below the offer price on listing date.

Conclusion / Investment Strategy

A niche player and leader of the segment on highest occupancy count, this IPO is sure to attract fancy post listing. A larger chunk of primary issue will be used to cut its debts and resultant boosted bottom line with lower finance cost. With its expansion plans afoot, it is poised for bright prospects. Off late we are also witnessing fancy for hospitality segment counters. Investors may park funds for the medium to long term rewards.

Review Author

DISCLAIMER: No financial information whatsoever published anywhere here should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is purely for educational and information purposes only and under no circumstances should be used for making investment decisions. Readers must consult a qualified financial advisor before making any actual investment decisions, based on information published here. With entry barriers, SEBI wants only well-informed investors to participate in such offers. With crazy listings in the past, SME IPOs drew the attention of investors across the board. However, as SME issues have entry barriers and continued low preference from the broking community, any reader taking decisions based on any information published here does so entirely at own risk. The above information is based on information available as on date coupled with market perceptions. The Author has no plans to invest in this offer.

(SEBI registered Research Analyst-Mumbai).

About Dilip Davda

Dilip Davda is veteran journalist associated with stock market since 1978. He is contributing to print and electronic media on stock markets/insurance/finance since 1985.

Dilip Davda is a leading reviewer of public issues and NCDs in the primary stock market in India. The knowledge he gained over 3 decades while working in the stock market and a strong relationship with popular lead managers makes his reviews unique. His detail fundamental and financial analysis of companies coming up with IPO helps investors in the primary stock market. Dilip Davda has a special interest in analyzing the SME companies and writing reviews about their public issues. His reviews are regularly published online and in news papers.

Email: dilip_davda@rediffmail.com

Courtesy: https://www.chittorgarh.com/